Jun25

Ally Invest Review Commission-Free Online Stock Trades

Comentarios desactivados en Ally Invest Review Commission-Free Online Stock Trades

Contents:

🔃 Updated February 2023 to reflect that Ally Invest has removed their $9.95 mutual fund transaction fee. I’ve been using Ally Invest as my primary stock brokerage for years. I started with TradeKing, stayed on during the acquisition, and have held a sizable portion of my investments with Ally Invest. Here are smart ways beginners can start investing in stocks and real estate, even with little money. So you want to know how to buy stocks online but have questions. Read on for an in-depth look, including ratings, reviews, pros and cons.

Ally Invest’s Managed Portfolio is the company’s equivalent of a robo-advisor account. Ally’s financial strategists research and select the funds your money goes into. This post is going to provide a full review of the services available with an Ally Invest account. I’ll also cover the fees that they charge, the pros and cons of being a customer, and more.

- But other than those few minor disadvantages, Ally Invest offers a full brokerage package at market-leading prices.

- Moreover, Ally Invest also offers users the option to customize their trading layout.

- However, you have plenty of European alternatives in both “Self-Directed Trading” and “Managed Portfolios” .

- Select independently determines what we cover and recommend.

- For example, you may want to know the stocks with the largest percentage gains and losses on a particular exchange.

- Ally Invest does offer a cash bonus, which varies depending on how much money you put into your account when signing up.

If you open a https://trading-market.org/ portfolio, you have some agency in what you choose to invest in, but the actual companies are chosen by Ally. I decided to give Ally’s managed portfolios a try, rather than the self-directed investing. My feeling here is that since I don’t yet think I have the know-how to do everything on my own….I’m happy to leave it to the professionals. You can also determine whether or not to buy a stock using the profit/loss and probability calculators, which will predict their potential performance based on previous data. Additionally, to get a more holistic view of your financial situation, you can also use the Maxit Tax Manager to see how your trades impact your taxes. This brokerage is a good choice for frequent traders who are looking for a fast platform with low costs that includes tools designed for day traders.

Intuitive trading experience

Want to give Ally Invest a go for all your stock trading and investing needs? Have a look at our full Ally Invest review to learn just how safe and secure the platform is. M1 Finance is a hybrid robo-advisor and traditional brokerage firm.

Ally Financial Is The Baby Being Thrown Out With The Bathwater … – Seeking Alpha

Ally Financial Is The Baby Being Thrown Out With The Bathwater ….

Posted: Sun, 26 Mar 2023 07:00:00 GMT [source]

You need to be a full-ally invest review resident of the United Statesand must have avalid social security numberto open an account with Ally Invest. It offers low-cost trading and a variety of wealth management options, including a cash-enhanced robo portfolio that has no fees. However, Ally Invest doesn’t currently offer fractional share investing and it doesn’t haven’t any no-transaction-fee mutual funds either. Current Ally customers who are willing to accept a limited roster of features to manage most of their finances at the same firm will find Ally Invest to be, well, convenient.

Tools and calculators

Provide the necessary information, including your social security number, income information, and other identifying data. In very simple terms, an option gives you the power to buy stocks at a fixed price for a fixed amount of time, no matter how the price fluctuates. Options trading can be tricky to understand, and they are really only used by advanced investors. Another way to think of it is that ETFs are made up of securities like stocks and bonds. Stocks are one of the most common investments as you surely know.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

In Information Technology – Software Engineering from Carnegie Mellon University, as well as a Masters in Business Administration from Johns Hopkins University. His approach to personal finance is that of an engineer, breaking down complex subjects into bite-sized easily understood concepts that you can use in your daily life. They are both under the same branding but the two systems still feel a little separate because they’re still separate entities. When you log into Ally.com to visit your banking, you can see your Ally Invest information.

Additional Features

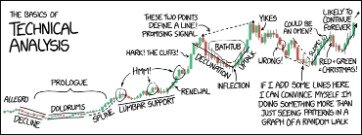

They don’t offer free trades of mutual funds but I invest in mutual funds directly with Vanguard so this isn’t an issue for me. You can easily buy stock with Ally with a Self-Directed trading account. Simply sign up for an account, link your bank account, deposit funds , and you’ll be ready to purchase stocks in no time. Ally Invest’s trading platform also allows you to access multiple stock charts, research and market data, ETF price and performance screeners, and options charts.

Access informational articles provided by Ally Invest to help you improve your understanding of investment strategies and market trends.

Unique Banking Model ❄️

As mentioned, Ally Invest only provides an ETF screener on the Ally Invest Live website. The stock screener’s basic functionality is utilized for both the mutual fund and ETF screeners on the primary website, with some adjustments as appropriate for the different asset types. For example, the mutual fund screener includes the total expense ratio as part of the criteria.

Founded in 1992, Saxo Bank is a Danish bank with an online trading platform with a wide range of products to trade . It serves people in +170 countries with a combined $16 billion in assets under management. First of all, it starts with a questionnaire to determine your investor profile. The objective is to know the right asset allocation according to your risk tolerance. Secondly, it requires you to make a minimum deposit of €3,000.

Sarah Sharkey is a personal finance writer covering retirement, investing, debt, savings, credit cards, mortgages, and student loans. Additionally, she is the founder of Adventurous Adulting, a personal finance blog dedicated to helping readers tackle their money and take control of the adventure of life. They’re one of the few investing platforms that offer no commissions on self-directed trading AND no annual fee for their robo-advisor.

But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you. Ally Invest makes money in the same way that other banks and brokers do. On brokerage accounts, Ally makes money from the practice of payment for order flow, or PFOF, as do nearly all other brokers in this age of $0 trades.

There are real-time quotes, research, a customizable dashboard, and it is all accessible online. Ally Invest offers stock trades at $0 per trade and options trading at $0 + $0.50 per contract. Ally Invest also is ideal for frequent traders due to a large amount of commission-free trades available. And if you’re looking to park your funds with a robo advisor, the Managed Portfolio might be a good option. In addition to ETFs, Ally Invest offers thousands of mutual funds to explore. However, mutual funds are actively managed by finance professionals and, as such, typically cost more than ETFs.

H&R Block Review 2023

Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Fortunately for consumers, free trading has increasingly gained traction in the industry as more companies opt for fee-free models.

Tastytrade offers some of the lowest commissions around, whether you’re trading stocks, options or even cryptocurrency – and it actually caps your commissions on the latter two. Traders should find a lot to like here, among the commissions, trading platform and the variety of trading securities on offer, though long-term investors may bemoan the lack of mutual funds. However, only a few account types are offered and If you’re looking to trade forex, futures or crypto, you’ll need to look elsewhere.

There are also blogs, market updates, and the ability to connect with other Ally Invest traders. The mobile app also has a research page that has news headlines, recent quotes, major market indices and their performance for the current day, and a list of NYSE market movers. There were no screeners available on the mobile app, but selecting a security brought up helpful fundamental information, technical data, and news for that security. The mobile app will likely meet the needs of traders who know what they want to trade.

Ally vs. SoFi: Which Bank Is Better for You? – GOBankingRates

Ally vs. SoFi: Which Bank Is Better for You?.

Posted: Tue, 21 Mar 2023 07:00:00 GMT [source]

Ally Invest has plenty of options for self-directed traders. And with no fees on many of those options, self-directed traders could keep all of their profits for themselves, rather than paying costly fees like most platforms charge. With Ally Invest, you can choose how you want to grow your money. Active investors can trade stocks, ETFs and options commission-free through Ally Invest’s Self-Directed Trading.

It’s mainly aimed at active traders who want to keep an eye on their stocks throughout the day. However, it does present significant limitations, including a narrow selection of investment choices and account types. Below, Select reviews Ally Invest’s offerings to give you the details on the investment options, features and fees so you can decide if it’s right for your needs. Ally Invest offers commission-free trading and four different types of managed portfolios.

B of A Securities Maintains Ally Financial (ALLY) Underperform … – Nasdaq

B of A Securities Maintains Ally Financial (ALLY) Underperform ….

Posted: Thu, 13 Apr 2023 06:25:00 GMT [source]

This markup or markdown will be included in the price quoted to you, and you will not be charged any commission or transaction fee for a principal trade. Keep in mind that the service fees noted as “waived” for Wealth Management may also be waived for your Ally Invest Robo Portfolio and Self-Directed Trading accounts. We require a minimum opening purchase of $100 per order on OTCBB and pink sheet stocks. We don’t charge commissions for stocks and ETFs priced $2 and higher. Keep in mind, each underlying ETF may charge its own internal expense ratio that are separate from our own listed annual advisory fees.

Ally also offers commission-free trading for exchange-traded funds , from companies like Vanguard. This is a great way to invest in a variety of companies at once in a way that is diverse and cost-effective. There are all kinds of ETFs, including those that focus on market indexes, those that focus on industry sectors, and those that focus on bonds and commodities, among other things. The Self-Directed trading option charges no fees for stock trades. Charging no fees for trades has become more common with online brokers, and Ally is the latest to join the group.

Recent Comments